Feie Calculator Can Be Fun For Anyone

Wiki Article

The Facts About Feie Calculator Revealed

Table of ContentsAbout Feie CalculatorUnknown Facts About Feie CalculatorThe Feie Calculator StatementsAll About Feie CalculatorMore About Feie Calculator

Initially, he offered his U.S. home to establish his intent to live abroad completely and requested a Mexican residency visa with his spouse to assist satisfy the Authentic Residency Examination. Furthermore, Neil safeguarded a lasting home lease in Mexico, with strategies to eventually acquire a building. "I presently have a six-month lease on a home in Mexico that I can extend one more 6 months, with the intention to buy a home down there." However, Neil mentions that purchasing residential or commercial property abroad can be challenging without first experiencing the location."It's something that individuals need to be truly diligent concerning," he claims, and suggests expats to be cautious of common mistakes, such as overstaying in the United state

Neil is careful to cautious to Anxiety tax united state that "I'm not conducting any carrying out in Illinois. The U.S. is one of the few nations that taxes its citizens no matter of where they live, implying that even if an expat has no income from United state

tax return. "The Foreign Tax obligation Credit rating allows people working in high-tax countries like the UK to counter their U.S. tax obligation liability by the amount they have actually currently paid in tax obligations abroad," states Lewis.

Feie Calculator - Questions

Below are a few of one of the most often asked inquiries concerning the FEIE and various other exemptions The Foreign Earned Earnings Exemption (FEIE) permits U.S. taxpayers to exclude as much as $130,000 of foreign-earned earnings from government revenue tax obligation, decreasing their united state tax liability. To get FEIE, you should satisfy either the Physical Visibility Test (330 days abroad) or the Bona Fide House Examination (show your main home in an international nation for a whole tax year).

The Physical Existence Test requires you to be outside the U.S. for 330 days within a 12-month duration. The Physical Visibility Examination also calls for U.S. taxpayers to have both an international earnings and a foreign tax home. A tax home is specified as your prime location for organization or work, regardless of your household's house.

Not known Facts About Feie Calculator

An income tax treaty between the U.S. and an additional country can help avoid double taxes. While the Foreign Earned Revenue Exemption decreases taxable revenue, a treaty might supply fringe benefits for qualified taxpayers abroad. FBAR (Foreign Checking Account Record) is a needed filing for united state citizens with over $10,000 in foreign financial accounts.Eligibility for FEIE depends on conference particular residency or physical existence tests. is a tax expert on the Harness system and the creator of Chessis Tax obligation. He belongs to the National Association of Enrolled Brokers, the Texas Society of Enrolled Representatives, and the Texas Culture of CPAs. He brings over a decade of experience benefiting Huge 4 firms, advising expatriates and high-net-worth people.

Neil Johnson, CPA, is a tax expert on the Harness platform and the creator of The Tax Guy. He has more than thirty years of experience and currently concentrates on CFO solutions, equity payment, copyright taxes, cannabis taxes and separation related tax/financial preparation matters. He is a deportee based in Mexico - https://www.quora.com/profile/FEIE-Calculator.

The foreign gained earnings exemptions, sometimes referred to as the Sec. 911 exclusions, omit tax on salaries earned from working abroad.

The smart Trick of Feie Calculator That Nobody is Talking About

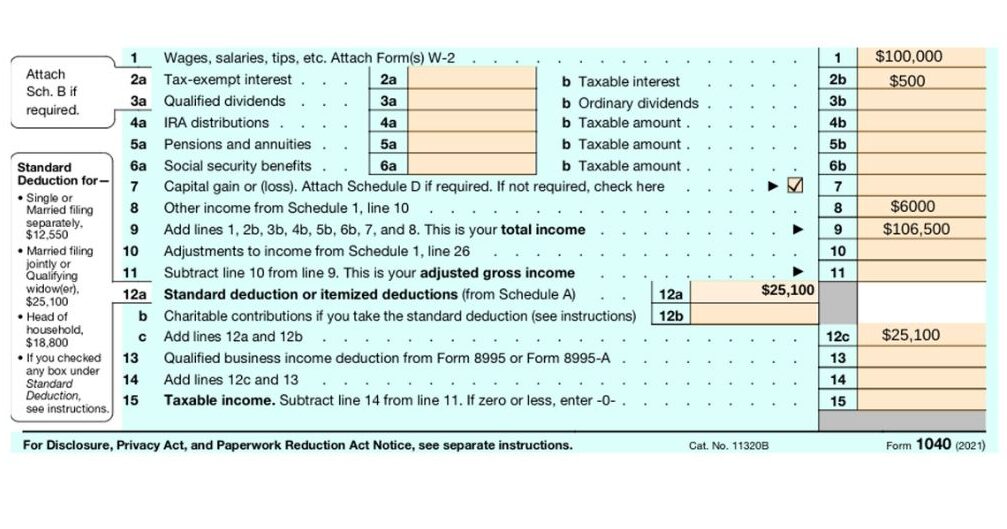

The revenue exemption is currently indexed for inflation. The optimal yearly revenue exemption is $130,000 for 2025. The tax obligation advantage excludes the revenue from tax at lower tax prices. Formerly, the exclusions "came off the top" reducing revenue subject to tax obligation on top tax prices. The exemptions may or might not minimize earnings made use of for various other functions, such as individual retirement account limitations, child credit histories, individual exemptions, etc.These exemptions do not excuse the earnings from US taxes but merely give a tax reduction. Note that a solitary individual working abroad for all of 2025 that made concerning $145,000 with no various other revenue will have gross income decreased to absolutely no - efficiently the very same response as being "free of tax." The exemptions are computed on a day-to-day basis.

Report this wiki page